Tax Credit for Energy Efficient Windows 2024

The Ecobonus, which is the tax deduction for energy efficiency in existing buildings, has been extended to December 31, 2024, and also the Home Bonus, which is the tax deduction in case of building renovation. Both benefits are attractive in case of replacing old windows and doors with new, higher-performance windows.

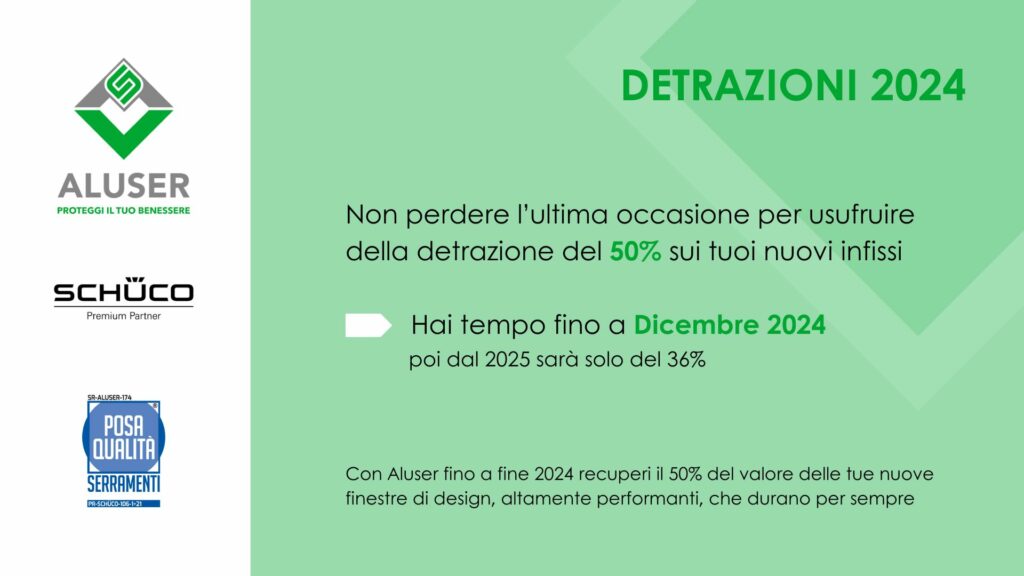

In both cases, the tax deductions for fixtures covers expenses incurred from January 1 to December 31, 2024. For both Ecobonus and Home Bonus, the 65 percent deduction due has now changed to 50 percent of the expense incurred, which will be paid back to the beneficiary over 10 years, in 10 annual installments. For example, on a total expenditure of €6,000 you will receive €3,000 back, divided into 10 annual installments of €300.

The main difference between Bonus Casa and Ecobonus is the audience of beneficiaries: Bonus Casa is an Irpef deduction that affects only individuals and residential buildings; Ecobonus, on the other hand, is a deduction both Irpef (in case of a natural person) and Ires (in case of a legal person), so it also involves companies and any category of building.

Another difference concerns the maximum expenditure allowed and the consequent maximum deductions: €60,000 maximum deduction with the Ecobonus (for a maximum expenditure amount of €120,000), €48,000 maximum deduction (maximum expenditure amount of €96,000) with the Bonus Casa.

Replacing windows and doors deduction 50 or 65? The right time to make your choice

The right time to replace windows and doors is now. For some years now, in fact, our government has been environmentally and sustainability conscious, helping citizens improve the energy efficiency of their homes through appropriate tax breaks. Over time the 65 percent deduction has increased to the current 50 percent and, presumably by 2025 it will return to the regular 36 percent. Last year, moreover, the Ecobonus included the possibility of assigning the tax credit corresponding to the due portion of the deduction to the suppliers of the windows and doors, thus immediately having a discount on the invoice, but for 2024 this possibility has been eliminated. Since the benefits seem to diminish over time, it is better not to put off the choice and ask for a free estimate today to replace old windows and take advantage of the 2024 window tax deduction.

The savings resulting from the replacement of windows and doors come not only from tax deductions, but also - and above all - from the improvement of the energy efficiency of our homes and the consequent reduction of the costs of heating and cooling our environments. Replacing our old windows and doors also means strengthening the commercial value of our properties, as well as their aesthetic beauty.

Ecobonus

The Ecobonus is applicable to all interventions that allow you to save on the cost of bills, so even the replacement of old windows with new ones with better performance or the installation of sunscreens that improve the energy efficiency of pre-existing windows. For these interventions the maximum deductible expenditure is set at € 60,000 per property unit.

Not all windows and doors are eligible for the tax deduction, but they must meet certain requirements and be accompanied by a performance certificate issued by the supplier. The performance must be within the legal limits in terms of thermal transmittance values, regardless of the material used.

The window and doorframes concerned by the tax deduction are windows, French windows and security doors (if they protect a heated room). As far as sunscreens are concerned, on the other hand, this includes not only awnings, but also shutters and blinds installed at the same time as the window frames.

Home Bonus

The Bonus Casa consists of a 50 percent deduction of expenses incurred for ordinary and extraordinary renovation work. The revenue agency has set the maximum amount of expenditure eligible for the benefit at 96,000 euros also for 2024 per individual unit. Individual building interventions carried out do not have an independent expenditure limit, but fall under the limit set for the housing unit.

In the specific case of windows and doors, this deduction concerns the reduction of the thermal transmittance of windows and doors, including frames, that delimit heated rooms from the outside and cold rooms. The frames that can be replaced are those that do not meet the levels of energy performance and thermal insulation required by the Decree of 11 March 2008.

The renovation bonus does not include the purchase and installation of solar screens: in that case you have to opt for the Ecobonus.

Bonus Removal of Architectural Barriers

UPDATE decree law of December 28, 2023: In 2024, the Architectural Barrier Removal Bonus is no longer applicable to the replacement of window frames.

The Architectural Barrier Bonus only covers work on alterations or new installation of stairs, ramps, elevator platforms, stair elevators and elevators.

Definitive Stop to Invoice Discount for Replacement of Fixtures

The only bonus for which the invoice discount was allowed was related to the removal of architectural barriers. As of 2024, therefore, it is no longer possible to take advantage of the direct invoice discount of the 75% tax deduction.

However, this is without prejudice to window replacement work begun before December 28, 2023, for which both the Architectural Barrier Removal bonus and the Invoice Discount apply. Here is the link to our guida Sconto in Fattura 75% per gli Infissi.

Documents needed for windows tax deductions 2024

The procedures for requesting tax deductions are now consolidated, but it is good to pay attention to avoid making mistakes. First of all, it should be remembered that the body that deals with the deductions is ENEA, the National Agency for New Technologies, Energy and Sustainable Economic Development.

To take advantage of the deductions for the year 2024, a form must be filled out on the ENEA website within 90 days of the date of completion of the energy upgrading work. In addition to personal data and that of the property concerned, the performance data of old and new windows and doors are required. Therefore, it is important to carefully keep all documents related to energy upgrading: the supplier's invoice, bank transfers of payments made to cover the expense, and the performance certification of the new windows and doors. The bank transfer, moreover, must be parlante: that is, it must contain the reason for the payment with the details of standard, the tax code of the beneficiary of the deduction and the VAT number of the supplier.

Take advantage of the 2024 window tax deductions for your new windows and doors, make an environmentally sustainable choice, increase the energy efficiency of your home for a cleaner world.

Request a Consultation

One of our technicians will answer you as soon as possible